As Ethereum ETF Price steadily climbs above $3,100 in mid-July 2025, all eyes are on the explosive inflows into newly approved ETH spot ETFs.

With institutional demand picking up and market sentiment turning cautiously bullish, a breakout toward the $4,000 mark may not be far off.

But is it just ETF hype—or something more substantial?

Let’s break down what’s really fueling the move, and why $4,000 ETH might be closer than most think.

ETH ETF Inflows Hit Multi-Month Highs

Since the SEC greenlit Ethereum spot ETFs in late Q2, institutions have wasted no time piling in.

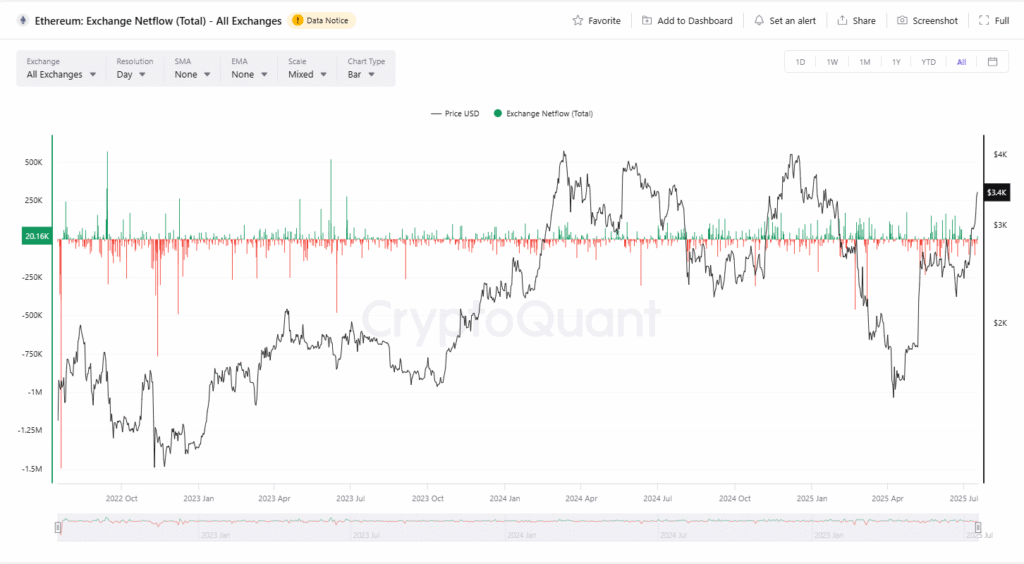

According to CryptoQuant, Ethereum exchange netflows have remained negative, suggesting long-term holders are moving ETH off exchanges — a bullish supply signal, especially alongside growing ETF demand.

According to CoinShares’ weekly digital asset flow report:

- ETH-based investment products saw over $620 million in net inflows in just the past three weeks.

- Trading volume in ETH ETFs has more than doubled since early June.

- Grayscale and BlackRock Ethereum ETFs have reported some of the highest inflows among all alt-based funds.

This isn’t just retail speculation—these are signs of serious capital rotation from traditional finance into crypto.

Key Insight: Institutional volume is often the precursor to long-term price appreciation in crypto markets. This trend closely mirrors what we saw with

BTC in Q1, right before its $70K breakout.

What’s Driving the Demand?

Ethereum isn’t just a crypto token—it’s the backbone of DeFi, NFTs, L2 scaling, and smart contract innovation.

Here’s why large investors are taking notice again:

- Deflationary Supply: Since the EIP-1559 upgrade and consistent burn mechanisms, ETH has turned net-deflationary.

- Yield Through Staking: ETH offers 3–4% native staking yield—attractive in a low-rate world.

- Layer 2 Growth: Rollups like Arbitrum, Optimism, and Base are flourishing, boosting ETH’s real-world use.

- Ethereum as “Tech Infrastructure”: Major institutions are comparing ETH to the next AWS or cloud layer for Web3.

Ethereum’s fundamentals have never looked stronger—even if prices haven’t caught up yet.

Retail Is Still Cautious—That’s Bullish

While ETFs bring institutional capital, the retail crowd remains hesitant. That’s understandable: most traders remember the whipsaw moves of 2022 and 2023.

However, this disconnect often sets the stage for explosive moves.

Just like Bitcoin hovered under $30K before its breakout, Ethereum sitting in the $3,000–$3,200 range might be the accumulation zone smart money prefers.

From the Ground: One Redditor summed it up: “ETH feels like it’s stuck… and that’s exactly how BTC felt before it ripped past $40K.”

ETH Price Forecast: Is $4,000 Realistic in 2025?

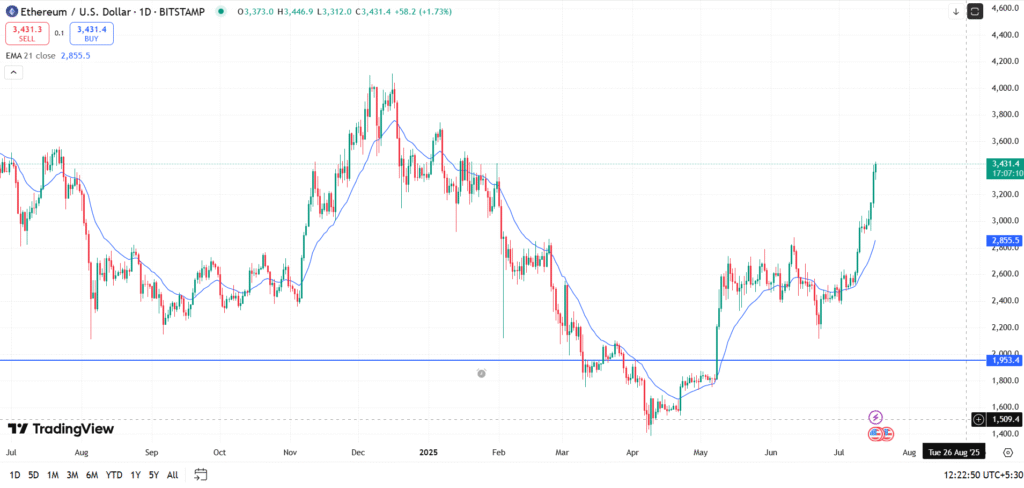

Based on technicals and current momentum, here’s how the road to $4K looks:

- Support: $2,880–$3,050 (strong demand zone from institutional buyers)

- Breakout Confirmation: $3,500–$3,650

- Target: $4,000 by Q3/Q4 2025, assuming macro tailwinds and steady ETF demand

Don’t forget: Ethereum price all-time high is $4,878. If this bull cycle mirrors the last, reclaiming $4K is not just possible—it’s probable.

What Could Go Wrong?

Of course, no prediction comes without risk. Key headwinds include:

- Regulatory Shock: Any surprise from U.S. policymakers could delay or halt ETF flows.

- Altcoin Liquidity Drain: If capital rotates too aggressively into BTC dominance, ETH may lag.

- Overcrowding in DeFi/NFT narratives: If retail jumps in too fast, it could create short-term bubbles.

Final Word: Don’t Sleep on Ethereum

With the Ethereum ETF story now unfolding and the network fundamentals better than ever, ETH looks increasingly like an asymmetric bet.

Is $4,000 a sure thing? Of course not.

But is it within reach with current inflows, deflationary supply, and growing real-world use?

Absolutely.

If you’re still on the sidelines, this might be the quiet before Ethereum’s next breakout.